How to Choose the Best Offer on Your Home

October , 6 2020

October , 6 2020  Selling Property

Selling Property  0

0

Super Special Ends 14th May 2023

October , 6 2020

October , 6 2020  Selling Property

Selling Property  0

0

The page you were looking for could not be found. It might have been removed, renamed, or did not exist in the first place.

Real estate investment represents a vital phase for every owner, irrespective of whether you’re relocating with your family or in looking for the profit options found with real estate investment. Among the many ways available in order to achieve your goal, one of the most sought-after choices is going with […]

Selling investment properties has become a little bit trickier in today’s economy. The many modern technologies like the Internet and online property portals have changed the real estate industry. Earlier property owners were completely dependent on real estate agents for the sale. However, with the introduction of online property portals, […]

The process has evolved over the years and has shifted the reins of property dealing from the hands of the real estate agent to the owner. How Does Listing a Property Online Benefit Sellers? Whether residential or commercial, the property owner can make the listing from the comfort of their […]

Suite 523, 2/454 Scarborough Beach Road, Osborne Park WA 6017 Australia

Copyright © 2010-2023 Minus The Agent

Weekly Campaign Report

Realestate.com.au directly email you campaign reports of your property’s weekly performance. This helps you to see how your listing is going and could also determine whether any changes may need to be made. Keeping track of your listing each week can help you potentially understand what is happening in the market. Also it will show that if you are not receiving the feedback you would have wished for, then it could be a good suggestion to alter your listing.

Listed On Realcommercial.com.au Until Sold

Your property will be listed on Australia’s No.1 property site. Minus The Agent offers a standard listing with the option to upgrade your listing at any time. It doesn’t matter if you are selling, renting or buying, being listed on Realcommercial.com.au can guarantee you will get the exposure you need.

You need t make sure that you update your listing every 90 days by logging to the portal if the property has not been sold, for the listing to keep active otherwise the listing will be withdrawn autometically and you need to purchase the package again.

List on other Portals

The first thing potential buyers see of your property online is the images. You want the best price possible for your home right? Then make sure it looks as best as it can by utilising a professional photographer to get the right shots and images of your home. Its all about first impressions and capturing the right angle, lighting and positioning of your property is vital to ensure you receive top dollar.Our professional photography company will come to your property at a day and time suitable to you and take unlimited interior and exterior photos

Pro Agent *

Our pro agent option is another fantastic option for those not sure whether to choose an agent or to sell yourself. What if I told you you can do both for a fraction of the cost! That’s right that’s what our pro agent option is all about. You get an agent to handle the online marketing, negotiations, contract preparation and paperwork, etc and all you have to do is the inspections with the prospective buyers. It is a great option for those not 100% confident with negotiations to hire an expert to do all that for them and the only thing you have to do is open the door for the buyer and leave the rest up to the agent. Available for a fixed fee of only $4999 it can be a great way to receive top dollar for your home at a fraction of the usual cost for an agent.

All packages allow unlimited text, up to 50 images, 2 floorplans,videos and open for inspection times plus more to be included. Minus The Agent uses a high-end software which allows you to create, change, add or takeaway any part of your listing at any given time. You are in control and have access 24/7 to make any changes you desire. However, if you are ever in need of any assistance, we are here to help. Whether it be photos, pricing, wording or open for inspection times, you have complete access to login and change any of that whenever you feel necessary.

Social Media Advertising Facebook & Twitter

Social media is huge and is still growing every single day. Minus The Agent has their own Facebook and Twitter account. We use these sites to advertise your property so that it catches the eye of the public. Frequent posts and boosts of your property ensure, it is not only displayed on major online portals but also through the use of social media, generating maximum exposure.

Sold sticker

A Sold Sticker with your sign for you to proudly stick over the top of your sign once you have successfully sold through our service and saved yourself thousands in commission.

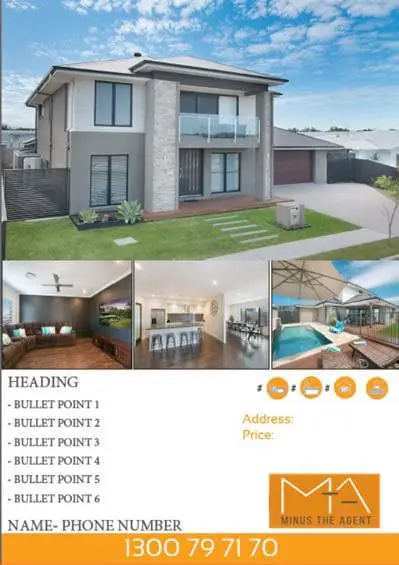

Photo Sign Board 1200×900

Enhance your property sale with this eye catching 1200 x 900mm professional photo board. Customisable to suit your needs or use our standard template of 4 images and 6 bullet points with your contact details on it. Our in house design team will draft up for you and only gets printed and delivered to you upon your approval.

Extra Open For Inspection Boards (each)

Want people to know about you’re having an open home? Open for inspection boards are what you will need. These not only allow people to know that you are having an open home, but also help the already interested buyers/tenants locate your home with no troubles. These boards are made out of the waterproof material core flute and come with double sided arrows.

Professional Brochures

All packages come with a downloadable standard pdf brochure you can print out and provide to buyers however our professional brochures make your property stand out and are a great way to enhance your property feel and value when providing to clients at open homes. Customisable to suit your needs and gets printed on 50x high quality gloss paper and delivered to you for inspections.

Professional Photography

The first thing potential buyers see of your property online is the images. You want the best price possible for your home right? Then make sure it looks as best as it can by utilising a professional photographer to get the right shots and images of your home. Its all about first impressions and capturing the right angle, lighting and positioning of your property is vital to ensure you receive top dollar.Our professional photography company will come to your property at a day and time suitable to you and take unlimited interior and exterior photos

All packages allow you to upload your own floorplan to your listing however if you haven’t got a floor plan then utilise our professional floorplan service to convert an old sketch or outline into a modern day floorplan to upload to your listing.

Featured Listing

Feature Listings appear above all standard adverts on realestate.com.au. They receive approximately 1.5x more enquiry than standard listings and on average sell 10% quicker than standard listings.

Photo Edit Enhancement (Per image)

Utilise our photo editing services to really enhance the look of your listing. First impressions count and if you need your personal images given a bit of life then select this extra and watch your listing shine above the rest

Removal of items from photos (Per Image)

Have images that look cluttered and messy? Utilise this service to remove all clutter and unwanted items in your image.

Virtual Furniture per room

Adding virtual furniture to an empty room can be a great way to showcase the best use of an empty space.

Professional Photography

The first thing potential buyers see of your property online is the images. You want the best price possible for your home right? Then make sure it looks as best as it can by utilising a professional photographer to get the right shots and images of your home. Its all about first impressions and capturing the right angle, lighting and positioning of your property is vital to ensure you receive top dollar.Our professional photography company will come to your property at a day and time suitable to you and take unlimited interior and exterior photos

Listed On Realestate.com.au Until Sold

Your property will be listed on Australia’s No.1 property site. Minus The Agent offers a standard listing with the option to upgrade your listing at any time. It doesn’t matter if you are selling, renting or buying, being listed on realestate.com.au can guarantee you will get the exposure you need.

List on domain.com.au

Having your property listed on domain.com.au is a great way to generate more enquiries for the reason that you have an extra listing. Being owned by Fairfax Media, Domain is one of Australia’s leading online property websites. Having your property listed on Domain could potentially lead to a quicker sale because of the extra exposure your property is getting.

List on other Portals

Combined with realestate.com.au, your property will be listed on multiple other property websites including Minustheagent.com.au, Allhomes.com.au (Excl NSW & ACT), Soho.com.au (Formerly homesales.com.au), Homes.com.au, Homely.com.au, Homehound.com.au, Onthehouse.com.au, Rent.com.au (rental property only), Property.com.au, Realty.com.au, Farmbuy.com.au & Horseproperty.com.au (for farm/rural listings only).

Professional Photo Board

Enhance your property sale with this eye catching 1200 x 900mm professional photo board. Customisable to suit your needs or use our standard template of 4 images and 6 bullet points with your contact details on it. Our in house design team will draft up for you and only gets printed and delivered to you upon your approval.

Extra Standard Sign Board

Minus The Agent has their own for sale boards, which are accessible to anyone who is interested. This 1200 x 900mm board will allow anyone to notice that your property is on the market. The sign is printed on the industrial, waterproof, material core flute. So, catch the eye of any interested homeowners, neighbours or investors by displaying one of these outside your property.

Social Media Marketing campaign

4 weeks worth of paid social media marketing campaign. Narrowed down to ensure return on investment is assured as it targets people looking in, living in or searching for property in your suburb/surrounding suburbs.

Standard Sign Board – 1200x900mm

Minus The Agent has their own for sale boards, which are accessible to anyone who is interested. This 1200 x 900mm board will allow anyone to notice that your property is on the market. The sign is printed on the industrial, waterproof, material core flute. So, catch the eye of any interested homeowners, neighbours or investors by displaying one of these outside your property

List on Realcommercial.com.au

Your property will be listed on Australia’s No.1 property site. Minus The Agent offers a standard listing with the option to upgrade your listing at any time. It doesn’t matter if you are selling, renting or buying, being listed on Realcommercial.com.au can guarantee you will get the exposure you need.

Listed On Other Portals Until Leased

As well as RealCommercial your property will get listed on Minus The Agent, Smarter Spaces and Lease.com.au”

List on other Portals

Combined with realestate.com.au, your property will be listed on multiple other property websites including Minustheagent.com.au, Allhomes.com.au (Excl NSW & ACT), Soho.com.au (Formerly homesales.com.au), Homes.com.au, Homely.com.au, Homehound.com.au, Onthehouse.com.au, Rent.com.au (rental property only), Property.com.au, Realty.com.au, Farmbuy.com.au & Horseproperty.com.au (for farm/rural listings only).

Listed on Domain Until Sold

Having your property listed on domain.com.au is a great way to generate more enquiries for the reason that you have an extra listing. Being owned by Fairfax Media, Domain is one of Australia’s leading online property websites. Having your property listed on Domain could potentially lead to a quicker sale because of the extra exposure your property is getting.

Listed On Realestate.com.au Until Sold

Your property will be listed on Australia’s No.1 property site. Minus The Agent offers a standard listing with the option to upgrade your listing at any time. It doesn’t matter if you are selling, renting or buying, being listed on realestate.com.au can guarantee you will get the exposure you need.

Sale Contract Package

Minus The Agent allow you to purchase all your contract of sale and document needs to sell your own home for every state in Australia.Click Here to find out more.

5 Application Process Includes TICA Ref Checks

Need Background/Reference Checks done before accepting your tenant? Take the stress out of this process and let our team process the application for you.

Rent Collection

Your rent collected and dispersed fortnightly to bank account of your choice.

Bond Lodgement

We will lodge the bond money to the Residential Tenancies Authority (RTA) for you.

Lease Preparation

Available in our Pro Manager package is a full lease preparation. General Tenancy Agreement written out in full as per the agreed terms and conditions between yourself and tenant.

Premier Listing Upgrade

Will put you as the largest possible upgrade available, appearing above all other advertisements online. Quicker turnaround time in finding a tenant and a greater enhanced feel of your listing.

SMS notification of new enquiries $49

All enquiries go into your portal and to your email address automatically however if you would like to be notified of new leads via SMS aswell simply add this function on.

RealEstate.Com.Au Upgrades

Upgrades on RealEstate.Com.Au include a featured upgrade, highlight upgrade and the biggest upgrade of all a premiere upgrade. Prices are dependant on a 30, 45 or 90 day upgrade and differ per suburb. Call our staff to find out the cost to you.

Auctioneer

Looking at going down the auction path? Let Minus The Agent find the best local auctioneers to you and provide a quote of the extra cost.

Mentor Support

Haven’t leased or sold your property and would like advice on getting a better result or different marketing strategies? Chat to one of our expert mentors as they can provide you constant updates, weekly check in calls and different tips, tricks and strategies to keep your listing looking fresh and active in the market.

Agent Support

Includes unlimited assistance and advice once your property has gone live. Any questions you have our agent team will be on board to guide you in the right direction.

AI Heading and Description

Struggling to come up with the heading and description for your listing? With our new and improved portal you now have the option to use AI techniques to write and suggest your heading and description in full for your online advertisement.

QR Code Check In

Holding open homes or inspections? Utilise our QR code check in system available in your dashboard to have buyers/tenants scan and register their full details prior to viewing your home!

Online Offer templates

When someone submits an offer, you will then receive an email notification and once logged in and click the ‘offers’ tab you will see the offers received and can make notes, etc.

Professional Copywrite

Our in house team pride themselves on the type of advertising that gets displayed online and are here to ensure your property stands out from the rest. After viewing your images and discussing the best features of your property, they will draft up the text of your advertisement to an expert level and send to you for your review.

Automatic Online Enquiry forwarding

All enquiries will be stored in your dashboard in the portal and get sent to you via email in real time automatically. You can also choose to be notified via SMS when an enquiry is received.

Telephone Support 7 Days a Week

All our packages come with complimentary customer service telephone support 7 days a week. Enabling you to utilise our friendly team for any questions you may have, to help you in the setting up of your property and running through any last grammar/spelling checks before going live.

Telephone Support 7 Days a Week

All our packages come with complimentary customer service telephone support 7 days a week. Enabling you to utilise our friendly team for any questions you may have, to help you in the setting up of your property and running through any last grammar/spelling checks before going live.

Enhanced Listing on Realcommercial.com.au

Will put you as the largest possible upgrade available, appearing above all other advertisements online. Quicker turnaround time in finding a tenant and a greater enhanced feel of your listing.

Enhanced Listing

Enhanced Listings appear above all standard adverts on realcommercial.com.au. They receive approximately 1.5x more enquiry than standard listings and on average sell 10% quicker than standard listings.

Automatic Online Enquiry forwarding

All enquiries will be stored in your dashboard in the portal and get sent to you via email in real time automatically. You can also choose to be notified via SMS when an enquiry is received.

All packages allow unlimited text, up to 50 images, 2 floorplans,videos and open for inspection times plus more to be included. Minus The Agent uses a high-end software which allows you to create, change, add or takeaway any part of your listing at any given time. You are in control and have access 24/7 to make any changes you desire. However, if you are ever in need of any assistance, we are here to help. Whether it be photos, pricing, wording or open for inspection times, you have complete access to login and change any of that whenever you feel necessary.

List on other Portals

Combined with realestate.com.au and domain.com.au, your property will be listed on 7 other property websites as well as the Minus The Agent site. These websites all help your property’s sale, as different buyers prefer different sites. We have created a list of the portals which your property will be displayed on for the very reason that we want you to sell your property and quickly as you do. These portals are all inclusive of realcommercial.com.au, smarterspaces.com.au, lease.com.au, minustheagent.com.au.

Listed on Smarterspaces.com.au Until Sold

Having your property listed on Smarterspaces.com.au is a great way to generate more enquiries for the reason that you have an extra listing. Being owned by Fairfax Media, Domain is one of Australia’s leading online property websites. Having your property listed on Domain could potentially lead to a quicker sale because of the extra exposure your property is getting.

Name & Phone Number Sticker

Want your name and phone number displayed on the sign board instead of ours? Purchase a sticker and have the buyers call you directly.

Title Search

Provided to you for your convenience to provide and include in the contracting stages

Rp Data Auto Appraisal

Wondering what price to list your home for? Receive a list of all recently sold properties in your area and an automated valuation of likely sale price and range.

Online Registration For Tenant Viewings

Don’t waste your time doing inspections not knowing who is going to show up. Use our online tenant register to have each person register before inspecting so you know who is going to be at your inspections.

Tenant Maintenance Reporting

Give your tenant access to our automatic app which will notify you anytime maintenance is required at the property.

Access To Rental Applications

All of our packages enable tenants to apply for your property directly online via realestate.com.au or via one of our application forms

Social media is huge and is still growing every single day. Minus The Agent has their own Facebook and Twitter account. We use these sites to advertise your property so that it catches the eye of the public. Frequent posts and boosts of your property ensure, it is not only displayed on major online portals but also through the use of social media, generating maximum exposure.

All our packages come with complimentary customer service automatic online enquiry forwarding. Enabling you to utilise our friendly team for any questions you may have, to help you in the setting up of your property and running through any last grammar/spelling checks before going live.